While I’m finishing up myths 4 and 5 behind the rising cost of college, let’s explore a popular, yet controversial, idea that is shaping the 2016 Presidential Election: free college for all.

Hillary Clinton has made a commitment to making college debt-free for the majority Americans, and many voters are quite invested in the idea of what a college tuition-free America would look like. I think it will look pretty much the same as it does now.

Since Donald Trump makes no mention of higher education on his campaign’s website, I will only be examining the merits of Clinton’s policy proposal. Here’s a quick summary of her New College Compact:

Clinton’s ambitious plan calls for eliminating in-state tuition payments for working families that make up to $125,000/year by the year 2021. She also plans to devote additional resources to assist low-income and underrepresented minorities to help offset the additional expenses associated with attending college, but does not clarify what is included in “non-tuition expenses.” This proposal is estimated to assist approximately 80% of college-bound individuals, comes with a few strings attached (requiring at least 10 hours/week of work study), and even claims to provide more accountability for institutions to decrease costs and increase completion rates.

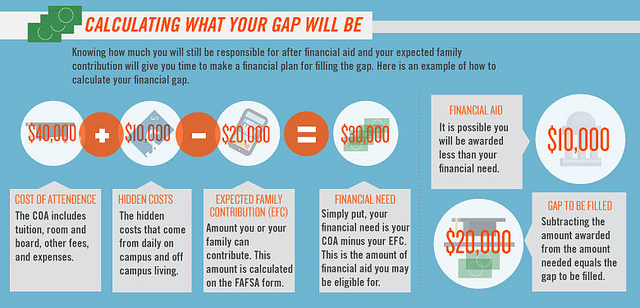

While her plan does account for tuition, and is a huge step in the right direction in cutting college costs, is does not contemplate the other expenses incurred while attending a university. With Clinton’s proposal, a qualifying, in-state student at the University of Alabama would save $11,270 in tuition, but would still need to come up with an $18,432/year to cover room, board, books, fees, and other “miscellaneous” expenses, not to mention the opportunity costs of earning extra income due to the work-study requirement. At Chico State, these same non-tuition expenses will cost an in-state student $16,816/year, over double the amount of tuition; and, at the University of New Hampshire, which already has an in-state tuition approximately $5,000 over the national average, a student will need and extra $17,790 to cover the remaining direct and indirect costs* ($3,214 of which are fees).

Even if a student has the ability to save money by living at home, they will still be responsible for paying thousands of dollars in indirect costs. These expenses can be covered by student loans, but what will prevent states from increasing or introducing new fees to make their budgets work? Will these future learners still need to take out loans comparable to today’s students?

This New College Compact does nothing for the 20% of U.S. college students enrolled at private institutions (with the exception of Historically Black Colleges and Universities), which often require students to take out more loans to cover higher direct costs. This is especially problematic considering that the institutions with highest student loan default rates are currently private-four profit schools. Inside HigherEd reports 47% of students who took out loans in 2009 to pay for The University of Phoenix defaulted within 5 years. However, this default rate seems to have little impact on the Apollo Group-owned institution. By 2014,The University of Phoenix’s student body owed $35.5B in student loans.

Moreover, while this plan does not guarantee admission to a public university, it also does not include any academic requirements to ensure that students are successfully matriculating towards earning a degree. According to the U.S. Department of Education, the national graduation rate is 43% (defined as completing a degree in 6 years—not 4), and attrition rates only increase as a student ages. The National Student Clearinghouse reports that drop-out rates increase from 25.4% for students >20 years old to 46.1% for students <20 years of age, and remain constant at 46.2% after the age of 25. While there is some evidence to indicate these rates may be attributed to cost, most studies reveal these rates are more closely correlated to a lack of college preparedness.

Clinton’s compact may make tuition free, but at what cost? With states cutting funding to colleges and universities at unprecedented rates, will institutions be forced to reduce quality to make ends meet, including cutting academic programs? Can they afford to sustain non-curricular programs like career services, student organizations, or athletics? Will they admit more full-pay, out-of-state and international students to offset cost or reduce overhead? Is there even enough on-campus jobs to sustain the 10-hour/week work-study requirement?

Without an additional compact with tax payers to simultaneously increase graduation rates while eliminating tuition, and still maintain the market value of a college degree, Americans cannot afford the $350 billion it will take to make college free. . . for most.

*A national, industry standard term. Direct costs include tuition, room, and board. Indirect costs include fees, books and supplies, transportation, and miscellaneous.

5 Myths Behind the Rising Cost of College in America: Part 3

5 Myths Behind the Rising Cost of College in America: Part 3