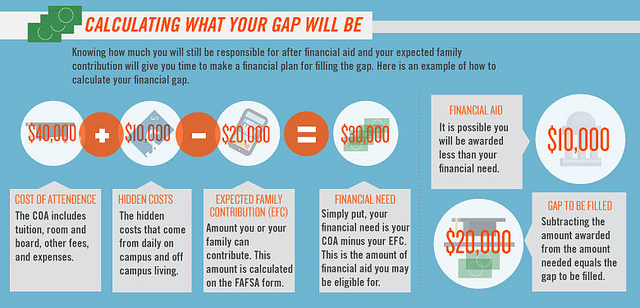

A quick search for “paying for college” will result in a number of websites claiming to reveal the secrets behind lowering the cost higher education. Their magic bullet? The net price calculator. This tool, featured on the College Scorecard, adds up both direct and indirect costs of attending a university and then subtracts estimated non-loan aid, such as scholarships and grants, revealing the amount students will be responsible for when paying for school. But, this net price calculator does not make college cheaper—it just estimates how much students and their families will need to take out in loans if they can’t pay out of pocket.

Of course, not all families will need to take out loans to cover the net cost of sending their child college. And, the argument may be made that the calculator helps informs students about the correct amount of loans they should take out in order to avoid over-borrowing, but institutions are required to issue refunds when excess loans are applied to an account.

Where the net price calculator fails, or rather what the net price calculator points out, is that students who do not qualify for aid will still often end up paying relatively the same amount for college.

Student financial aid does not have a universal definition. Colloquially, student aid includes any type of money earmarked for the purposes of helping a student through college, from private scholarships, to federal or state grants, to federal or private loans. For the purposes of the net price calculator only considers these sources of “free” money, and qualifying for these types of aid (and staying qualified) is much more tricky than filling out the FASFA itself.

The Pell Grant, the most common type of federal grant, comes with a laundry list of non-financial qualifications, will only award a maximum of $5,815 for the 2016-2017 academic year (AY), and may only be applied for up to twelve semesters. In AY 2007-2008, only 96.5% of Pell Grant recipients had an AGI below $50,000. Only 28% of those who were awarded a Pell Grant in AY 2011-2012 received the maximum amount of $5,550. For AY 2015-2016, 38,015 of the students attending the University of Phoenix received a Pell Grant, creating revenue for the for-profit institution to the tune of $96.6M. This also made University of Phoenix the top institutional recipient of grant monies that year.

The Federal Supplemental Educational Opportunity Grant (FSEOG) is considered campus-based aid as these monies are given to institutions to distribute at their discretion. The list of schools participating in FSEOG is not publicly available, and priority is often given to students who are already receiving Pell Grants. TEACH Grants provides aid to those who want to be teachers in high-needed areas, but the maximum award of $4,000 decreases by 6.8-6.9% per year and converts into a Direct Unsubsidized Loan if the recipient does not fulfill their service obligation. Even free money isn’t free when it comes to federal student aid.

The net price calculator is not driving up the cost of college, but it’s not helping the financial burden, either. It only highlights how challenging it is for an average student to receive federal aid.

Does Tuition-Free College Really Solve the Student Debt Crisis?

Does Tuition-Free College Really Solve the Student Debt Crisis?